Sunday, October 14, 2007

One-derful for Myer?

And amid Bernie's latest profit announcement came an update on the Myer One program. Bernie stated the program had 1.6 million customers on board, growing by 30,000 a month, and that over 55% of sales were on the program, compared with 43% at the time Coles sold Myer.

The growth figures are impressive. But I'm interested in 55% "penetration" of sales being a similar badge of honour. So is it a case of the higher the better? To my way of thinking, with $1,000 spend attracting a $20 gift card on Myer One, that means that 55% of Myer's sales are subject to this 2% discount. It all depends. If that discount is helping to lock in those sales, then fair enough. But what proportion of those sales was Myer going to get anyway? Does Myer know?

Because the tricky little key to loyalty programs is to offer the carrot in return for "sympathetic" shopping behaviour from your customer. If the carrot is being snapped up by customers who remain indifferent to you, then you've not gained.

Ignoring the above, with so many customers on board, Myer is collecting a lot of great information about its shoppers. And that in itself is valuable. And with Myer sharing a place in the same family as Debenhams, you'd hope that some of the learning gained by TPG with that retailer may be of benefit in harnessing the power of the data within Myer's grasp.

The Myer One program, in global terms, is in the middle of the pack as far as department store loyalty offerings are concerned. Certainly the changes they made about a year go turned it from something that was possibly too smart (read "complicated") for its own good, into an uncomplicated offering that delivers some benefit for its loyal shoppers. The new store card, and the soon-to-be-launched Visa Card may well work in well with the program. There are some signs that they're starting to do some good things with their data. Measuring the actual incremental benefit is a critical question that remains outstanding, but among all the arrows in Bernie's quiver, this One may well hit the target.

Tuesday, June 26, 2007

Sub Club sunk

I am old enough to have observed my children’s tastes swing markedly over the years from McDonald's to Subway. While Maccas seems stuck in a no-man's-land between cringing promotion of its healthier-than-healthy options while still trying to satisfy the basic urges of the chip-and-burger brigade, Subway has successfully ridden the public wave of better eating.

Subway’s offering is straightforward and uncomplicated. While none of its franchisees or their staff has attended a Subway equivalent of

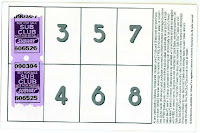

But one change has been the demise of Subway’s loyalty program, Sub Club. It was long lasting, fairly simple to execute and rated about a three out of five stars for customers. In classic green stamps fashion, you were handed a number of coupons or stamps based on what you’d bought, affixed them to your Sub Club card, then redeemed when you’d filled up the card. Fairly simple mechanism.

Where Subway lost points was that it wasn't quite simple enough. While the stamp-earning formula was fairly straightforward (one stamp for a "six-inch", two for a "foot-long"), it was more confusing how the “burn” end worked out. I always had to remind myself from the fine print on the card what I really would get out of it. And it was - collect 8 stamps (one full card), then if I buy "one medium fountain beverage", I’d get a free six-inch sub for nothing. Alternatively, I could collect 16 stamps and get a free foot-long sub if I purchased a fountain drink.

With loyalty programs it matters less if I don’t perfectly understand the "earn" rate, but if the “business end” is hard to understand – the “what’s-in-it-for-me” bit, then that’s more of a problem. Also, if it has too many hurdles – in this case the mandatory drink purchase - then it can start to lose gloss.

Nevertheless, with Subway’s Sub Club, I soldiered on. With all my family members happy to frequent Subway, we racked up he stamps rather quickly, and I got used to the way the deal worked. I was even handed stamps at a Subway in

But Subway wasn't enjoying the deal as much as I was, and last year announced the end of the party. No more Sub Club.

Subway didn’t fare too badly. It gave customers plenty of notice about when the stamps would no longer be handed out; it gave them plenty of time to cash in their chips and then when it was all over it actually handed out cash discounts for any cards not filled up – a 100% redemption rate play at the end of the promotion. Hard to fault that. The only thing that irked was their mixed messages about why they were pulling up stumps. The notice in-store stated that the Club meant that only some customers, not others, were getting the goodies, so it was somehow inequitable. Purlease! Try extending that principle elsewhere in society! The reason more widely promoted, even by Subway, was that the opportunities for fraud, no doubt coupled with general moral decay was pushing up the share of chancers and sheisters getting unscheduled access to treats. When Sub Club stamps became widely available on eBay, Subway's owners were not overly impressed. Even worse was the talk of staff theft of the stamps, evidenced by entire rolls of stamps appearing online! So maybe the demise was inevitable.

The bit of data I don’t have regards the residual impact of stopping the loyalty program. Of course there’s no public data available on that. And it would be hard for the Subway bean counters to work that out as well. Because ultimately loyalty programs only offer the cream on top. The world’s most effective loyalty program is only going to add a marginal benefit to the bottom line. Could be worth millions if you’re big enough, but not so easy to read off a 3-D column chart or a low-angled, tilted, chunk-out pie chart!

In some countries, a new Subway loyalty card has sprung up. But for us in the rest of the Subway world, we're missing our stamps. Would Subway be regretting its move? What do you think?

Tuesday, June 5, 2007

Forgot to show my card and save

Show Your Card & Save is the benefit program adopted by Australian Auto Clubs over the last few years, apparently lifted from a scheme set up in the

I was intrigued by the long list of benefits on offer when it was first spruiked by RACV, the automobile club to which I belong. Certainly in terms of volume it seems to beat any similar offering I've seen.

And yet there is something intrinsically frustrating about this benefit program. And that is, I just can’t remember who the benefit providers are. The only one I've been able to commit to memory is Rebel Sport, 5% discount there, quite useful. But of all the rest, I just can’t recall. At one stage I kept the page out of the RACV mag that has the list of participants, but it’s not as if I’m going to carry it with me.

Yet here’s the rub. You can bet that nearly all the benefit providers won’t be putting up in lights that they’re part of the Show Your Card & Save program. After all, what’s in it for them, once you're in the store? They’d be hoping that before I set out to purchase an item, I’d check out the list and head their way, but I'm afraid it’s just not going to happen that way. And they’re not about to ask me at the check-out if I'm an RACV member – it would be akin to them asking me “how would you like to claim 5% of my margin that you weren’t really expecting as a discount?”

So I see it as a bit of a loyalty program with your hands tied behind your back. For the participating retailer, they’ll be handing out the occasional discount, but it’s hard to see members seeking them out, if like me they suffer from the can’t-remember-who’s-in-it problem. For an RACV member like me, there’s the frustration of finding out some time later that I had foregone a discount, if only I’d remembered to show my card and saved. And what’s in it for RACV? Well, maybe they’re the winner in all of this – they get to paint the picture to members that there’s a world of discounts waiting for them. Maybe only the astute (or anal) member will delve deep into the list and find out that some of the participants are giants of commerce like Wombat Gully Plant Farm or Wooling Hill Memorial Garden Estate.

Sunday, April 22, 2007

Some opening points

From the frequent flyer programs of Ansett and Qantas in the early 1990's, the watershed introduction of FlyBuys in1994, the proliferation of credit card programs in the wake of FlyBuys, through to the crafted retail programs of the 21st century such as MYER one or EmailCash, the Australian loyalty landscape is worthy of commentary.

From the frequent flyer programs of Ansett and Qantas in the early 1990's, the watershed introduction of FlyBuys in1994, the proliferation of credit card programs in the wake of FlyBuys, through to the crafted retail programs of the 21st century such as MYER one or EmailCash, the Australian loyalty landscape is worthy of commentary.What have Australian retailers got to learn? Have these programs made a difference? Why do companies invest? Do customers really care? What if they all disappeared? What makes one program more effective than another? How do Australian loyalty program shape up against similar programs overseas? What about the Australian retail scene makes a loyalty program more or less effective in Australia compared from their overseas counterparts? How do similar markets such as New Zealand compare? There are many points to ponder. I hope, if you've stumbled by, it's a rewarding journey!